The Facts About Retirement Planning Revealed

Wiki Article

The Of Retirement Planning

Table of ContentsThe Definitive Guide for Retirement PlanningThings about Retirement PlanningSome Known Details About Retirement Planning Retirement Planning - TruthsAbout Retirement Planning

A cornerstone of retirement preparation is determining not only just how much to save, however likewise where to conserve it. If you have a 401(k) or various other employer retired life plan with matching bucks, take into consideration starting there. If you don't have a workplace retirement, you can open your own pension.In general, the best plans provide tax advantages, and, if available, an additional savings incentive, such as matching contributions. Some workers are missing out on out on that totally free money.

There are several networks you can use to save for retired life. Devoted retirement strategies have the benefit of tax-free development on your savings, and you also obtain tax obligation reductions from your contributions in your annual tax returns. Some retired life strategies in South Africa are set up by your company with payments coming from your income.

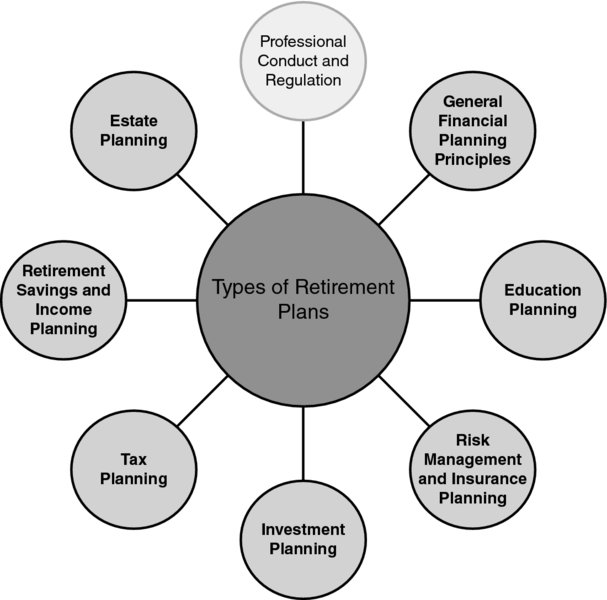

To aid you understand the different retirement plan options, benefits, as well as demands, we've created this retirement planning guide that you can describe when considering your retirement:: A pension plan fund is used to conserve for retirement and also gets constant contributions (generally monthly) from you and also your company.

The Buzz on Retirement Planning

: A provident fund resembles a pension plan fund, with the difference that when you resign or retire, you can take the entire cost savings quantity as cash if you want. You don't need to buy an earnings plan, but you will be tired on the cash money payment based upon the round figure tax table.Something failed. Wait a minute and also try once again. Try again.

Points don't constantly go to strategy. Past the uncertainties of financial recessions, business close down all the time as well as work functions come to be repetitive as modern technology and requires adjustment.

Your decision to maintain infiltrating your retirement may not constantly be your own to make a decision. A crash or retrenchment might burglarize you of your ability to remain utilized as well as earn a wage at any moment. Ought to anything take place to your member of the family, you may likewise discover it necessary to take time off job to care for your enjoyed one.

The 7-Minute Rule for Retirement Planning

The pace of modification in the operating globe is speeding up, and also your skillset may be outdated if you have stayed out of the labor force for numerous years off to recuperate from, or deal with somebody with, a clinical condition. To support against potential economic impacts of the uncertainties life will toss your method, you are typically encouraged to:.This is a good choice if you appreciate your work or wishes to proceed creating income in retired life. In some cases called a sabbatical, these short periods of leisure occur between different occupations or repetition occupations. You may take a number of months or a complete year to travel, for instance, before heading back into the world of job.

Numerous people use the tool to see what they can do to help boost their chances of retired life success. You must explanation also believe regarding how you will certainly spend for medical and long-term treatment expenditures in retirement. Some people assume that Medicare will certainly cover most or perhaps all of their healthcare costs in retirement.

One way to technique retired life financial preparation is to plan by life phase. In various other words, what retirement preparation actions should you be taking at each of the key stages of your life?

Retirement Planning - An Overview

They may have started a family as well as thought economic commitments like a home mortgage, life insurance, numerous automobile repayments, as well as all of the expenditures involved in elevating youngsters and paying for their education and learning. With contending priorities, it's vital to establish particular and also obtainable goals. The great information is that these are typically the optimal making years for many individuals and also couples, providing them an opportunity to make a last solid press toward the retired life goal by maxing out contributions to retirement financial savings plans.If you stop functioning, not only will you lose your paycheck, yet you may likewise shed employer-provided health insurance policy., many individuals will not be covered by Medicare till they reach age 65.

If you were provided an interest-free financing for thirty years, would certainly you take it? With any luck the answer is yes, given that you might profit for years off the 'complimentary' financial investment returns of that cash money. That is basically the manage many retired life programs, where the government car loans you the cash you would have paid in taxes on your income and you do not need to pay it back up until retirement (possibly at a reduced tax rate).

Millions of people utilize the device to see what they can do to help improve their possibilities of retirement success. You need to additionally think of just how you will pay for clinical and lasting care costs in retirement. additional info Some people assume that Medicare will certainly cover most or perhaps every one of their healthcare expenses in retirement.

The Ultimate Guide To Retirement Planning

One means to strategy retired life economic planning is to strategy by life stage. In various other words, what retirement preparation steps should you be taking at each of the vital stages of your life?

If you quit working, not just will you lose your income, however you might additionally lose employer-provided wellness insurance coverage. there are exceptions, the majority of people will certainly not be covered by Medicare up until they get to age 65. Your company needs to be able to tell you if you will have wellness insurance advantages after you retire or if you are qualified for momentary continuation of wellness protection.

If you were offered an interest-free car loan for three decades, would certainly you take it? With any luck the response is of course, given that you can benefit for decades off the 'free' investment returns of that cash money. That is essentially the take care of many retired life programs, where the government car loans you the cash you would certainly have paid in taxes on your income and you do not need to pay it back until retired life (possibly at a lower tax rate).

Report this wiki page